News

Chinese Automobiles: “Caught in the ‘Vortex’ with No Way Back”

In recent years, the competition in China’s automotive industry has become increasingly fierce, widely described as a situation of “no way back” in the midst of a “turbulent” market.

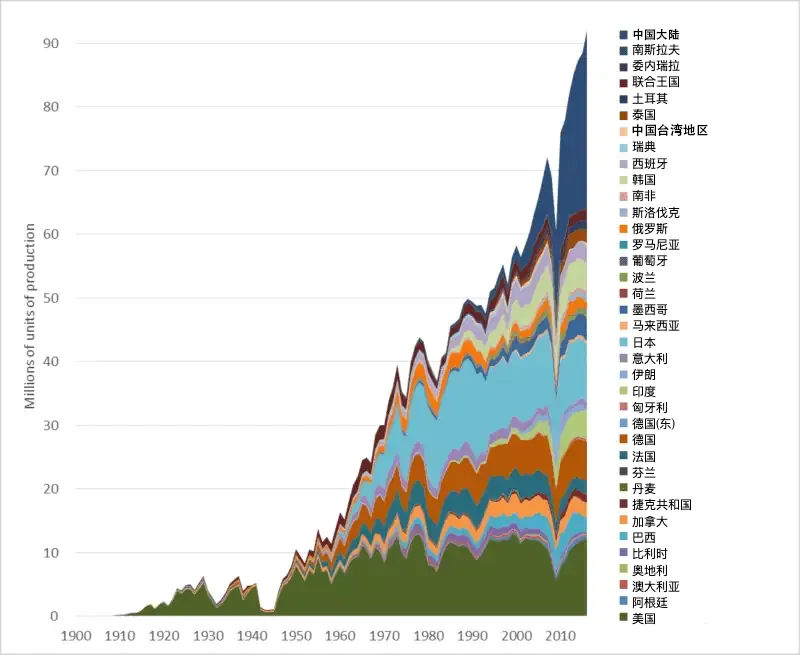

Since the beginning of 2023, a new price war has swept through the Chinese automotive market, escalating in intensity. This price war involves not only domestic brands but also joint ventures. They are fighting for a larger market share or maintaining their sales volume through direct price cuts or the symbolic launch of new car models. According to data from DASOUCHE, in June 2023, the discount rate for secondary networks (discounts offered by non-brand authorized dealers) in the Chinese market exceeded 19%, with the discount rate for traditional energy models reaching as high as 24%, far higher than the normal level of about 10% before 2019. This significant and sustained discounting strategy has led to a reversal of the downward trend in car sales in the context of a worsening domestic environment, with sales picking up during the 2023 to 2024 period.

According to statistics from the China Passenger Car Association (CPCA), from January to May 2023, the cumulative production of narrow passenger cars in China reached 11.59 million units, a year-on-year increase of 5.3%; the cumulative wholesale sales volume reached 11.75 million units, a year-on-year increase of 6.1%. Although sales have increased, driving growth in industry revenue and profits, the overall profit level of the industry has been declining since 2016. From January to May 2023, the revenue of China’s automotive manufacturing industry was 3.90 trillion yuan, up 6.8% year-on-year, with a total profit of 204.7 billion yuan, up 17.9% year-on-year. However, the industry’s profit margin has dropped to only 5%, a historic low.

In particular, China’s top ten automakers, despite achieving sales of 23.15 million units in 2023, had a net profit of less than 200 billion yuan, with a net profit margin of just over 4%. In contrast, Toyota, the world’s largest automaker, achieved a net profit of 228 billion yuan with sales of only 10.31 million units during the same period, with a net profit margin of 11%, approximately three times that of Chinese automakers. This situation has led to deep reflection on the future of China’s automotive industry: despite taking a leading position in the global automotive new energy revolution, why is it still difficult for the entire industry to achieve profitability? What is the root cause of this “not making money”? Is it truly just that the domestic market competition is too intense, or are there deeper issues at play?

CATEGORIES

LATEST NEWS

CONTACT US

Name: Ms Tina

Mobile:+8613884463677

Tel:+8613884463677

Whatsapp:+8613738490136

Email:[email protected]

Add:Room2104-3, Block A, Ningbo Chamber Of Commerce Building, 558 Tiantong South Road, Shounan Street, Ningbo, Zhejiang, China