News

China’s Auto Makers to Expand Rapidly Overseas, Capturing 33% of Global Market by 2030

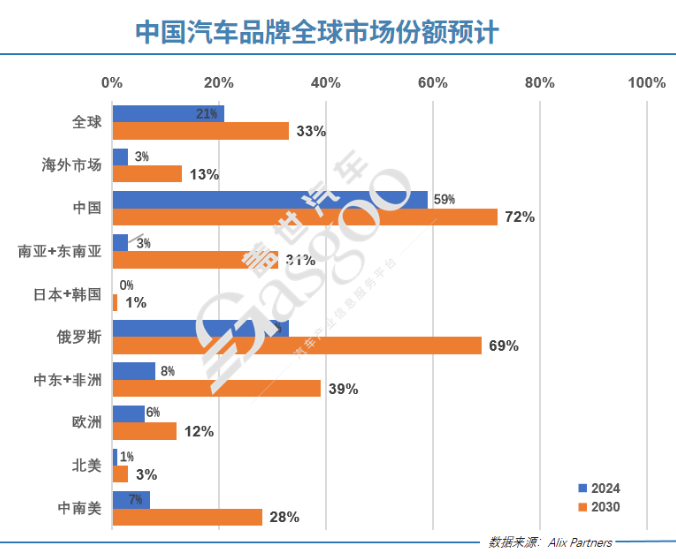

In contrast, this year, Chinese automakers are expected to hold a 21% share of the global automotive market. The majority of this market share growth will come from markets outside of China, with sales of Chinese automakers abroad expected to increase from 3 million units this year to 9 million units by 2030. The overseas market share is expected to rise from 3% to 13%.

AlixPartners predicts that Chinese brands will grow in all global markets. However, the company adds that expansion in Japan and North America will be relatively slower, especially in the United States, where vehicle safety standards are stricter and tariffs on imported Chinese electric vehicles can reach as high as 100%.

In North America, Chinese automakers are expected to hold just a 3% market share, primarily in Mexico, where one in every five cars is expected to be a Chinese brand by 2030. AlixPartners also predicts that Chinese automakers will see exponential growth in most other major regions, including South America, Southeast Asia, the Middle East, and Africa.

In the domestic market, AlixPartners expects Chinese automakers to increase their market share from 59% to 72%. This is due to the rapid rise of companies like BYD, Geely, and NIO, which have caused significant market share losses for traditional automakers like General Motors.

In Europe, Chinese automakers have been growing rapidly, and AlixPartners expects their market share to double to 12% by 2030.

Mark Wakefield, Global Co-Head of Automotive and Industrial Practice at AlixPartners, said in a statement, “China is the new disruptor in the automotive industry – able to create cars that get to market faster, are cheaper, have more advanced technology and design, and are manufactured more efficiently.”

According to AlixPartners, Chinese electric vehicle manufacturers typically take 20 months to create new products, half the time of traditional automakers, by fully meeting standards through design and testing without over-engineering. Additionally, Chinese automakers have a 35% cost advantage.

The rapid expansion of Chinese automakers is increasingly causing concern among global traditional automakers and political circles. Many worry that lower-priced Chinese-made cars will flood the market, weakening the competitiveness of locally produced models, especially electric vehicles.

Wakefield said that for traditional automakers to compete with Chinese automakers, they need to rethink their business development processes and the speed of car development.

CATEGORIES

LATEST NEWS

CONTACT US

Name: Ms Tina

Mobile:+8613884463677

Tel:+8613884463677

Whatsapp:+8613738490136

Email:[email protected]

Add:Room2104-3, Block A, Ningbo Chamber Of Commerce Building, 558 Tiantong South Road, Shounan Street, Ningbo, Zhejiang, China